Information on VAT Correction for Unpaid Liabilities after 1 January 2025

Information on VAT Correction for Unpaid Liabilities after 1 January 2025

From 1 January 2025, a new provision (§ 74b of the VAT Act) comes into effect, regulating VAT deduction corrections for irrecoverable and overdue receivables. This change concerns the repayment of VAT deductions on unpaid liabilities.

New Obligation

The new rule applies only to taxable supplies received from 1 January 2025 onwards, for which the recipient has claimed the right to a VAT deduction. The practical application begins in July 2025. The obligation to reduce the VAT deduction arises if a liability for a taxable supply is not fully settled by the debtor by the last day of the sixth calendar month following the month in which it became due.

Correction Process

The correction of the VAT deduction is made for the tax period in which the last day of this obligation falls.

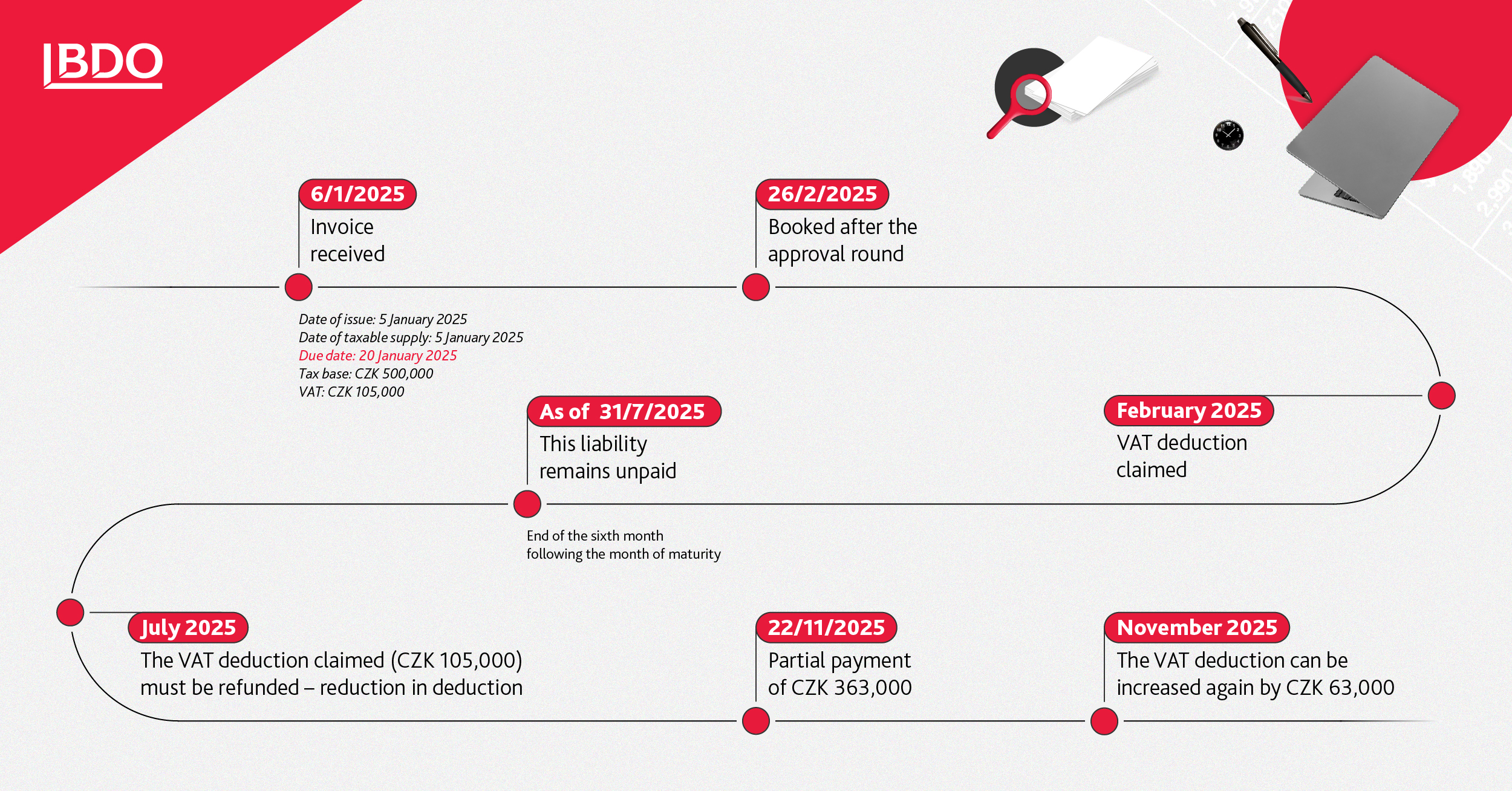

Example

A debtor (VAT payer) receives a taxable supply on 5 January 2025 and claims a VAT deduction (tax base = CZK 500,000, VAT = CZK 105,000). The liability is due on 20 January 2025, but the debtor has not paid it by 31 July 2025. In this case, the debtor must return the entire amount of VAT claimed for the July 2025 tax period or, where applicable, the third quarter of 2025.

Accounting Procedure

The debtor accounts for the return of VAT deduction using an internal accounting document, most often posting the correction as an expense. If the debtor later settles the liability, he can reclaim the VAT deduction proportionate to the payment made.

Example

The debtor partially settles the liability on 22 November 2025 (tax base = CZK 300,000, VAT = CZK 63,000). The debtor can correct the VAT deduction by CZK 63,000 for the tax period of November 2025 or, if applicable, the fourth quarter of 2025.