In connection with the windfall profits tax effective from 1 January 2023, the Financial Administration is taking further steps to meet the needs of taxpayers affected by this new obligation beyond the corporate income tax.

The General Financial Directorate, in cooperation with the Ministry of Finance, published the expected content of the forms that will be made available in the database of tax forms of the Tax Administration upon completion of the legislative process, namely:

1) Declaration for windfall profits tax (25 5563 MFin 5563 - Template No. 1) incl. instructions for completion (25 5563/1 MFin 5563/1 - Template No. 1)

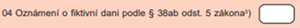

- The template form is two pages long and can be used simultaneously for the "Fictitious Tax Notice"

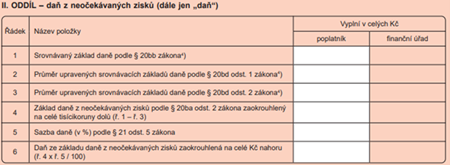

- After the taxpayer's identification data (Section I), Section II follows. This is the section for the calculation of windfall profits tax

- Section III is devoted to the additional tax return and Section IV to payment of tax

- There is also a table for the signatory's details and a Request for Repayment of Overpayment for windfall profits tax

(Source: https://www.financnisprava.cz/assets/cs/prilohy/dt-databaze-aktualnich-danovych-tiskopis/5563_1.pdf)

2) Notice of shifting the average of adjusted comparative tax bases within a group of business with unexpected profits (25 5261 MFin 5261 - Template No. 1, incl. instructions for completion (25 5261/1 MFin 25 5261/1 - Template No. 1)

- The first page of the form is for filling in the details of the taxpayer's representative and the signatory

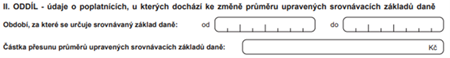

- Section II is used to identify the taxpayer whose average adjusted comparative tax base is increased and the taxpayer whose average adjusted comparative tax base is decreased, after the information on the period and the amount being transferred has been completed

(Source: https://www.financnisprava.cz/assets/cs/prilohy/dt-databaze-aktualnich-danovych-tiskopis/5261_1.pdf)

The Financial Administration also published in the section Taxes > Income tax > Windfall Profits Tax >

Questions and answers summary of answers to the most common questions on the application of the windfall profits tax. This set of questions and answers is divided into four areas. Within each section, the following selected conclusions are drawn for taxpayers:

TAXPAYER AND GENERAL QUESTIONS

- The taxpayer does not have to register specifically for the windfall profits tax.

- The conditions determining whether a taxpayer becomes subject to windfall profits tax are assessed separately for each tax year or tax return period.

- The same provisions apply to the tax period, or the period for which the tax return is filed, as for corporate income tax, and the same rules apply to filing deadlines.

- The taxpayer files a tax return even if the tax is zero.

- The tax rate is 60% of the tax base. No tax credit can be applied to the tax.

- Windfall profits tax is a tax on the taxpayer, it cannot be recognised as a tax expense.

- In the case of a group where the taxpayer has a foreign parent company, both the income of the Czech company and the income of the foreign company taxed in the Czech Republic are included in the relevant income.

- The income of landlords from recharging electricity and gas to tenants does not fulfil the characteristics of income from a decisive activity.

TAX BASE ON WINDFALL PROFITS

- Within a group, the average of the adjusted comparative tax bases can be transferred from one taxpayer to other taxpayers in the same group, and one taxpayer can also be the recipient of adjusted comparative tax bases from several taxpayers. This intention will be notified to the tax administration by means of the "Notification of transfer of average of adjusted comparative tax bases" form.

- The other questions and answers in this section are devoted to specific examples on averaging adjusted comparative tax bases.

BINDING ASSESSMENT

- The taxpayer may ask the tax administrator to assess whether it is part of a group of enterprises with windfall profits together with another taxpayer. The tax administration does not assess whether the taxpayer is a windfall profits taxpayer.

- The application is subject to an administrative fee of CZK 10,000, with the number of fees being derived not from the number of applications but from the number of relationships between pairs of taxpayers, which the tax administrator assesses and issues a separate ruling on.

- The request for a binding assessment will always be submitted to the Specialised Tax Office.

ADVANCES ON WINDFALL PROFITS TAX

- The windfall profits tax is subject to similar provisions governing advance payments of income tax.

- A different arrangement applies for the first advance period, which runs from 1 January 2023 to the last day of the deadline for filing the windfall profits tax return for the first period.

- For the purpose of determining the advance in the first advance period (from 1 January 2023), the amount notified by the taxpayer in the notice of notional tax or the notional tax on windfall profits determined in the decision of the tax administrator will be used.

- Notice of fictitious tax can be made by means of a windfall profits tax return form

with the appropriate subject designation; no special form is published (see point 1). Failure to file the notice by the filing deadline will subject the taxpayer to a non-monetary penalty.

This temporary extraordinary tax obligation (valid for the 2023-2025 period) still raises a number of further questions. We encourage you to review the above-mentioned Q&A list on the Financial Administration's website and if you do not find the answer to your situation, we will be happy to help you navigate and set up this new obligation.